1. What are the loan purposes?

The Pag-IBIG Fund Affordable housing Program (AHP) may be used to finance any one or a combination of the following:

- -Purchase of a fully developed residential lot or adjoining lots not exceeding 1,000 square meters;

- -Purchase of a residential house and lot, townhouse, or condominium unit; (Check out THIS LINK for properties)

- -Pre-owned or new;

- -A property mortgaged with the fund;

- -An acquired asset of the Pag-IBIG Fund; or

- -Adjoining houses and lot / townhouses / row houses / condominium units.

- -Construction or completion of a residential unit on a lot owned by the borrower or a relative of the borrower;

- -Home improvement; or

- -Refinancing of an existing housing loan.

AFFORDABLE HOUSING PROJECTS IN CAGAYAN DE ORO:

-

-SUMMERVILLE at Upper Palala, Lumbia, Cagayan de Oro City.

-

-LUMINA HOMES at Gran Europa, Lumbia, Cagayan de Oro City.

-

-BELLA VITA by Ayala Land at Indahag, Cagayan de Oro City.

-

-BRIA HOMES – Gran Europa, Lumbia, Cagayan de Oro City.

2. Who are eligible to apply for Affordable Housing Program?

The Affordable Housing Program (AHP) is available to Pag-IBIG Fund active members, including OFW’s who:

-

-Must have at least 24 monthly savings. The lump sum payment of the required 24 monthly savings is allowed.

-

-Has a gross monthly income not exceeding ₱17,500.00;

-

-If with existing Pag-IBIG housing account, it must be updated;

-

-Have no outstanding Pag-IBIG Short-Term Loan in arrears at the time of loan application;

-

-Have the legal capacity to acquire and encumber real property;

-

-Have passed satisfactory background/credit and employment/business checks of Pag-IBIG fund;

-

-Not more than 65 years old as of date of application and must be insurable;

-

-Had no Pag-IBIG housing loan that was foreclosed, cancelled, bought back due to default or subjected to Dacion en Pago.

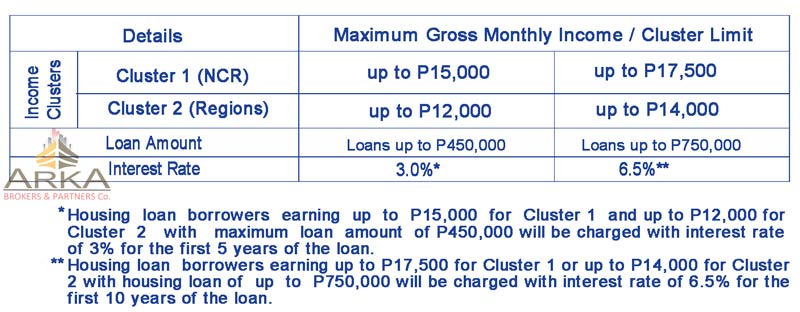

3. How much can a member borrow?

-

A borrower may borrow as much as Php750,000, which will be based on the lowest of the following:

-

-Members actual need – his loan entitlement based on gross monthly income and capacity to pay,

-

-Loan-to-appraised value ratio.

-

At the end of the 5-year or 10-year period, the interest rate will be repriced based on the prevailing interest rate in the Fund’s Full Risk-Based Pricing (FRBP) Framework. For borrowers opting for a 3-year or 5-year fixing period, the interest rate will be repriced based on the prevailing interest rate in the FRBP framework or it will be increased by two percent (2%) whichever is lower.

The maximum repayment period for the loan is thirty (30) years.

4. How to apply?

Online scheduling for the submission of Housing Loan Application and requirements:

-

-Housing Loan applicants may schedule an appointment through Online Housing Loan Application (OHLA) for the submission of their Housing Loan Application Form and requirements*. The institutional Housing Department will contact applicants with high loan amount and had good initial credit rating for submission of the required documents via email to expedite their process.

* There is NO online submission of Application Form and requirements.

-

-To get a schedule, housing loan applicants can log-on to: www.pagibigfundservices.com/.

-

-Scheduling through this system requires the Pag-IBIG Membership Identification Number (MID) or Registration Tracking Number (RTN) or the Temporary Identification of the member-applicant for log-in and security purposes. The system assigns a unique reference number known as the Housing Loan Application Tracking Number.

-

-Applicants must accomplish the online form. The applicant must provide the following Loan information: Purpose, mode of payment, desired loan term, and desired re-pricing period; Personal Information: email address, cellphone number, homeownership, years of stay in present address, occupation, years in employment or business, number of dependents, gross monthly income, and their preferred Pag-IBIG office where application and requirement will be submitted. Click “Submit”.

-

-The applicant will receive an email indicating his schedule for the submission of Application Form and requirements, the name of the Pag-IBIG contact person, and address of the Pag-IBIG office where the application will be submitted. The applicant’s reference number will be sent via text message (SMS).

-

-A special lane in Pag-IBIG branch office is available for those who made an online schedule and will be given priority over walk-in applicants.